Getting My cardholder To Work

Getting My cardholder To Work

Blog Article

We do not guidance this browser Model anymore. Using an updated Variation will help guard your accounts and supply a far better experience.

The name of your bank card differs depending on the bank card issuer and the kind of card. The charge card name commonly incorporates the name of the cardboard issuer and the type of card it really is.

Now obtainable across qualified Mastercard customer and smaller small business rewards charge cards, cardholders can entry, and get paid new meaningful benefits and financial savings on their own buys, details involve:

The editorial written content on this webpage relies exclusively on goal, unbiased assessments by our writers and isn't influenced by promotion or partnerships.

Create a NerdWallet account for insight on your own credit score and customized tips for the correct card for you.

Even with on the web fraud, a lacking name alerts a little something may very well be amiss to retailers. The account operator identity desires verification. So The common-or-garden cardholder name plays a refined but significant fraud avoidance role Over-all!

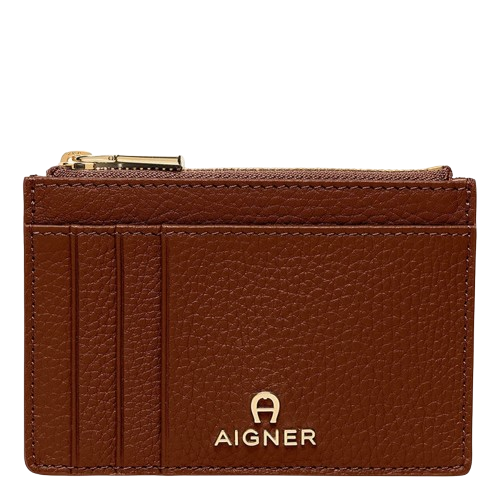

Debit and bank cards might be useful applications for paying, but cardholder it's easy to overlook all of the data packed into each bit of plastic.

Even though it might seem to be an easy piece of data, the cardholder name holds substantial significance in safe transactions.

You’re likely knowledgeable about Visa and Mastercard bank cards. They’re credit card networks that provide a technique of conversation between a merchant and issuer to finish a transaction. Some bank card networks, which include Learn, are also issuers.

Every charge card contains a name that identifies the card’s issuer. The monetary establishment or entity, generally a financial institution, to which you’ve used for the bank card is called the credit card issuer.

(As mentioned over, authorized consumers generally don't have the right for making improvements to your account, although the exception is if they wish to eliminate them selves from your arrangement.)

Regardless of whether you wish to fork out a lot less desire or gain much more rewards, the right card's in existence. Just remedy a handful of thoughts and we will narrow the look for you.

This nameless void alerts added scrutiny is needed. Vendors are going to be added suspicious of nameless card use, so be expecting frequent ID checks and denied transactions.

A secondary cardholder is also called an authorized user or even a supplementary cardholder. Remaining a secondary cardholder means that a Major cardholder has provided you access to their account, which means you can also make buys working with some other person’s credit history account.